Digital Innovation and Financial Optimization in Logistics Connecting with freight carriers to improve supply chain financing

By land, by sea, or in the air: The logistic industry is transforming. The logistics sector is one of the most important drivers and beneficiaries of globalization and digitalization. It accounted for an annual turnover of EUR 1,050 billon in Europe in 2017. Forecasts predict a continuous worldwide increase – especially in road freight transport volume – until 2050. This development creates chances and challenges for the market participants: Is the logistics sector sufficiently prepared for continuous growth, necessary investments, and supplement financing needs? Increasing demand for logistics services requires capacity and could result in shifting bargaining power and the need for more flexible financing solutions. Logistics service providers have to navigate between the demands of their customers and the challenges and requirements of their freight carriers to ensure healthy growth. The key issue becomes a successful intermediation and collaboration to control the cash flow and financing in the supply chain.

Navigating between the demands of customers and challenges of freight carriers

In this challenging environment, many logistics service providers are threatened by decreasing margins, additional needs of liquidity, and an insufficiently funded supplier base. First market players have started connecting with their freight carriers, optimizing their financing, and preparing for sustainable growth.

How can networks and digitalization increase liquidity, optimize financing and enhance long-term relationships in the supply chain?

The cflox market place

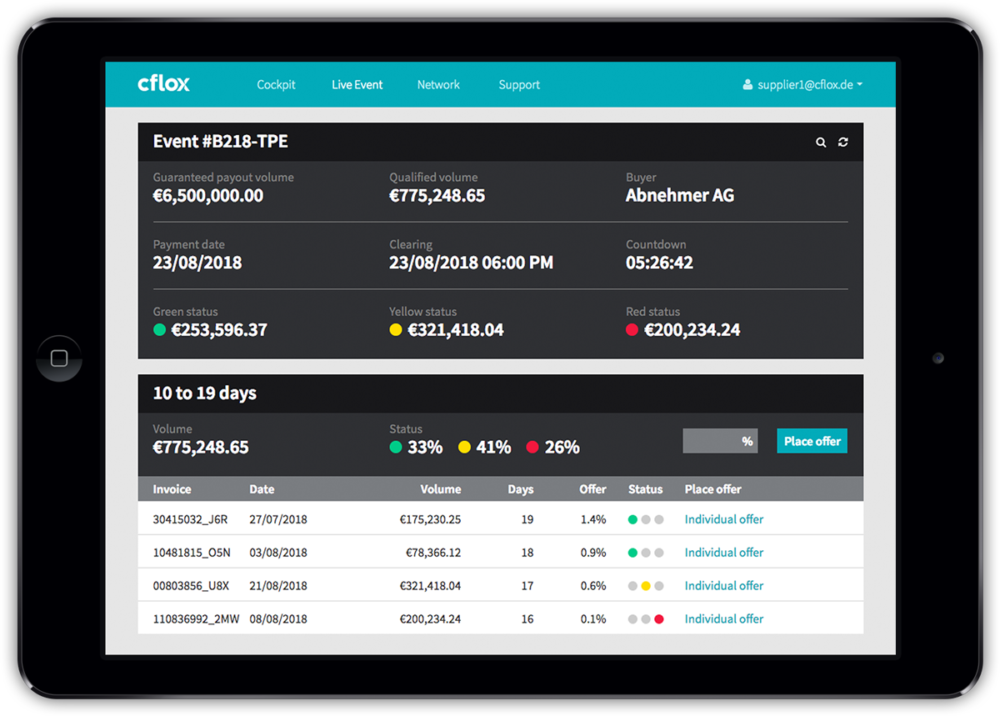

cflox connects logistics service providers with their customers and freight carriers. It provides supplier management and financing solutions to handle the challenges in the logistics sector.

Additional liquidity by converting receivables into instant payments.

Long payment terms towards suppliers while suppliers receive early payouts.

Additional discounts by investing available excess liquidity into early payments to suppliers.

Potential in the supply chain. cflox – The Collaborative Market for Working Capital

Client Case

A logistics service provider from Germany was faced with a major challenge: On the one hand, the company had to enable longer payment terms to its own costumers, and on the other hand, it could not further increase its payment terms towards a large number of freight carriers. How could a solution be implemented?

The solution: cflox liqui+

The logistics service provider is using cflox liqui+ to extend their own payment terms towards the freight carriers while, at the same time, enabling early payouts:

- Payment terms against freight carriers were extended from 30 to 60 days.

- Freight carriers can access the cflox platform to realize early payouts – as soon as five days after approval.

- The logistics service provider connects with a high number of its freight carriers by using the digital platform.

The cflox financing partners conduct early payouts to the freight carriers and provide intermediary financing to fulfill an extended payment term for the logistics service provider. The entire transaction is processed via the cflox market platform. Established order and invoicing systems and processes remain unchanged.

WIN-WIN: Mutual benefits

Innovative technology and a lean implementation

cflox provides cutting-edge technologies to connect logistics service providers and their customers and freight carriers easily and efficiently. A high number of companies can be connected to the platform without internal effort.