Principles

Financial strength through optimized payables

We develop solutions to finance sustainable growth of the entire supply chain: Buyers can extend payment terms towards their suppliers while suppliers receive early payouts of qualified invoices. Buyers and suppliers both benefit from optimized cash flow and Working Capital.

Platform

How we make a difference.

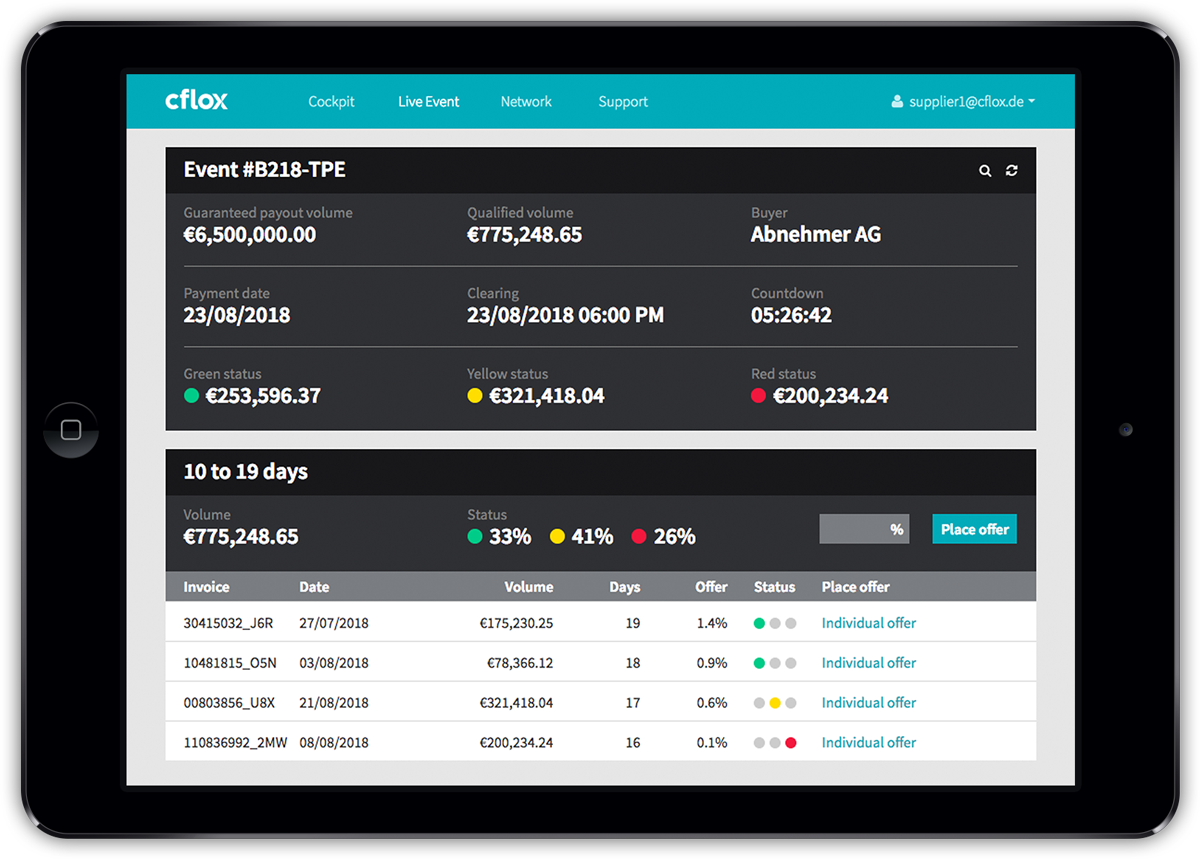

The cflox platform for Supply Chain Finance

cflox is different: we facilitate flexible and comfortable financing within the supply chain. No matter if you engage with just a few or rather a few hundred suppliers or if you need to submit only a handful or thousands of invoices – we process data digitally, lean, and secure. Flexible interfaces, instant roll-out and onboarding, and comprehensive services make the difference and minimize your operative effort.

Customer example

Case Study: Optimized supplier payment terms

The goal was to help a thriving e-commerce company finance its growing operations: the payment terms towards their suppliers were systematically extended. To negotiate these with large supplier corporations, the client offered them the early payout through the cflox financing solution. This systematic campaign can increase the average payment term from 23 to 60 days and thereby freed up liquidity and strengthened the Working Capital for future growth. Existing procurement and invoicing processes remained the same.

Day 1

Order and delivery

The client places an order using their regular standard procurement process. The suppliers deliver the goods or services and send the corresponding invoices.

Day 8

Invoice activation on the cflox platform

The client activates the invoice on the cflox platform. This can be done manually or through an automated interface to the ERP system.

Day 23

Payout to suppliers

The suppliers receive their payment at the agreed short payment term. The payment is authorized via the cflox financing facility.

Day 60

Payment by buyer

The client pays his invoices within the new long payment term. Until then the Working Capital is strengthened by increasing the trade payables.

Contact

Interested?

Contact us!

Successful supply chains optimize the financing of Working Capital directly and dynamically. How can cflox help you optimize your cash flow? Contact us now to receive further information.